Want to buy agricultural land? This ag land sales guide will help you find listings, evaluate land value, and understand soil quality. Read on to make an informed choice and secure the best farmland for your needs.

Table of Contents

Key Takeaways

Understanding budget and operational needs is essential for farmers when searching for farmland, with various platforms like Land.com and AcreValue Community offering extensive listings and resources.

Key factors in farmland evaluation include soil composition, productivity indices, and historical crop data, which determine the land’s agricultural potential and influence investment decisions.

Accurate land valuation techniques, regional market trends, and mortgage data insights are crucial for making informed purchasing decisions and ensuring strategic investments in agricultural properties.

Browse U.S. Agricultural Land Sales

Farmers have several options for acquiring land, including lease, rent, or purchase. Understanding your budget and operation needs is key when searching for farmland. A farmer assessing your financial situation is the first step in making a sound investment. Once you have a clear budget, you can explore various platforms to find the ideal piece of land.

Land.com serves as a robust marketplace for rural real estate, providing access to numerous listings of farms, ranches, and other rural properties. This platform is invaluable for those seeking to purchase or lease ranch land, offering tools to filter properties based on criteria such as location, size, and price.

Additionally, the AcreValue Community connects over 12 million monthly users, providing resources for searching land sales, real estate support, and connecting with landowners and farmers across acres.

Whether you’re eyeing the fertile fields of Iowa, the lush landscapes of Georgia, or the expansive ranches in Illinois, these platforms can help you navigate the market effectively. These resources can help you find land that meets your needs and aligns with your long-term goals.

Access Parcel Ownership Information

Understanding who owns a piece of land and its specific details is vital in the land acquisition process. GIS plat maps provide comprehensive parcel information, including parcel number, acreage, and the owner’s name. These maps are essential tools for anyone looking to find land and additional property types, providing a clear picture of the ownership landscape.

GIS plat maps cover over 2,700 counties, making it easier for prospective buyers to gather detailed information about potential properties. Access to this information ensures buyers are well-informed about the land they are considering, aiding in strategic decision-making.

Evaluate Soil Composition and Productivity

One of the most critical aspects of evaluating farmland is understanding its soil composition and productivity. In Iowa, the Corn Suitability Rating 2 (CSR2) is utilized to assess soil productivity, which can significantly influence land valuation. Similarly, the Illinois Productivity Index (PI) incorporates various soil factors to determine potential crop yields in Illinois. Minnesota uses the Crop Productivity Index (CPI) to evaluate soil suitability for different crop types.

Healthy soil is characterized by rich organic matter, good structure, and appropriate moisture levels, all of which are crucial for maximizing productivity. Understanding these factors helps in assessing the potential of the land to support various crops and ultimately impacts the farm’s profitability.

Soil productivity ratings are not just numbers; they are vital indicators of a farm’s potential. Evaluating these ratings helps prospective buyers make informed decisions about the land’s suitability for their agricultural goals. This process ensures that the investment made into the land translates into fruitful harvests and sustainable farming practices.

Historical Crop Data Analysis

Analyzing historical crop data is crucial for informed farming decisions. Farmers can access crop rotation history for the last five years, providing valuable insights into the land’s productivity and suitability for different crops. This data aids in planning future planting decisions and enhances farm records.

Moreover, farmers can utilize eight years of historical crop rotation data to further inform their planting strategies. The CSB data sets, covering the years 2015 to 2022, are available for download, allowing users to view data at the state and county levels.

Historical crop data is vital for optimizing farm operations and ensuring long-term productivity.

Land Valuation Techniques

Valuing agricultural land accurately is a complex but essential process. The average value of U.S. farmland reached $4,080 per acre in 2023, reflecting a 7.4% increase from the previous year. However, farm real estate values vary significantly across regions, with the Corn Belt seeing values nearly twice the national average. Understanding regional market trends is crucial when evaluating land.

Several valuation methods can be employed to determine land value. The sales comparison method approximates land value by comparing it to similar recent sales in the area. The income approach focuses on the income-generating potential of the land to determine its value. The cost approach calculates land value based on acquisition and development costs, factoring in depreciation. Residual land value is often used by developers to assess future profits after subtracting development costs.

Key factors influencing land value include location, size, zoning laws, accessibility, market trends, and the availability of infrastructure. To accurately value land, one should research the market, consult experts, inspect the land, analyze zoning, and apply appropriate valuation techniques. This comprehensive approach ensures a fair and strategic investment in agricultural properties.

Mortgage Data Insights

Mortgage data plays a crucial role in understanding land price trends and identifying marketing opportunities. CoreLogic provides transaction-level mortgage data that covers 99% of U.S. parcels, offering granular insights for local markets. Timely updates on mortgage market data, typically provided daily, ensure that users have current information for accurate market analysis.

AcreValue Premium users can monitor trends, observe activity, track prices, and identify marketing opportunities using detailed mortgage information. This data provides a deeper understanding of the financing landscape, aiding prospective land buyers in making informed purchasing decisions.

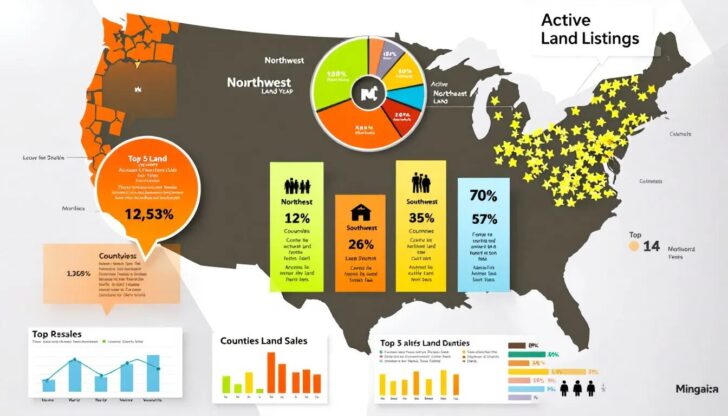

Active Listings of Land for Sale

Listings of land for sale cover a variety of property types, including undeveloped land, farms, ranches, timberland, and hunting land. These listings can be tailored to meet specific needs by filtering based on criteria like location, lot size, and price. This customization allows buyers to find land that aligns with their agricultural goals and budget.

Detailed descriptions and photos are often included in listings, providing buyers with a comprehensive view of the property. These details help buyers assess the land’s potential and make informed decisions. Furthermore, platforms allow users to connect with real estate agents specializing in agricultural properties, facilitating smoother transactions.

Whether you’re looking to buy land in Florida or sell your acreage in another state, these active listings provide a valuable starting point. These tools can streamline your search, helping you find the perfect piece of land for your needs.

Critical Infrastructure Considerations

The proximity to critical infrastructure is a key consideration when evaluating farmland. Access to energy systems like power plants and substations is vital for assessing the land’s usability and potential. The presence of oil and gas wells nearby can also influence the agricultural land’s value and functionality.

Effective land management and agricultural planning require understanding the layout of energy infrastructure. Types of critical infrastructure resources to assess include substations, wind turbines, oil & gas wells, power plants, ethanol plants, biodiesel plants, and soybean plants.

These factors can significantly impact the land’s operational efficiency and overall value.

Networking Opportunities for Landowners

Connecting with the agricultural community is vital for landowners. Registering as a landowner on various platforms can facilitate connections and provide access to valuable resources. An engaging online presence through social media and newsletters helps build trust and connect with rural clients.

Local events like fairs and farmers markets help land brokers build significant community connections. Collaborating with local businesses and joining professional associations related to land can further enhance networking opportunities and community presence.

Offering excellent service in rural areas can lead to strong word-of-mouth referrals, expanding one’s network. Hosting workshops on relevant topics can position landowners as trusted experts in their field, fostering stronger relationships and creating new opportunities.

Market Reports and Trends

Market reports provide critical insights into rural and agricultural land trends, helping users make informed decisions.

The USDA reported that the average value of U.S. farmland in America reached $4,080 per acre in 2023, reflecting a 7.4% increase from the previous year.

Between 2022 and 2023:

Cropland values increased by 4.6% to an average of $5,460 per acre

Pastureland values rose by 3.2%

Rental rates for U.S. cropland also saw a 1.3% increase, reaching $155 per acre.

Soil indices provide insights into the productivity levels of farmland, impacting its market value. Market Intelligence aids in identifying new market opportunities by analyzing trends, consumer preferences, and competitive landscapes. Detailed insights from CoreLogic’s Market Intelligence can help mortgage professionals understand market threats and opportunities.

Regions like the Corn Belt have significantly higher farmland values, nearly double the national average, due to favorable economic and geographic conditions. The Southern Plains region exhibited the highest annual growth rate of farm real estate values at 2.9% from 2017 to 2022. Potential renters or buyers must evaluate the land accurately before making a commitment.

Learn more, visit Guide to Buying a Farmland – Wendyflor lifestyle

Summary

Summarize the key points discussed in the blog post. Emphasize the importance of thorough research and informed decision-making in buying farmland. Highlight the critical aspects such as soil composition, historical crop data, valuation techniques, and the significance of networking and market trends. Conclude with an inspiring phrase encouraging readers to take the next step in their agricultural journey.

Frequently Asked Questions

How can I access parcel ownership information?

You can access parcel ownership information through GIS plat maps, which detail acreage and owner names for over 2,700 counties. This resource can provide you with the necessary data in a comprehensive format.

Why is soil composition important when buying farmland?

Soil composition is crucial when buying farmland because it directly influences crop yields and the overall value of the land. Understanding metrics like CSR2 and PI helps in making informed purchasing decisions.

What historical crop data is available for analysis?

Historical crop data available for analysis includes crop rotation history for the past eight years and CSB data sets from 2015 to 2022, aiding farmers in making informed planting decisions and improving farm records.

What are the different land valuation techniques?

The primary land valuation techniques are the sales comparison approach, income approach, cost approach, and residual land value method. Each technique serves specific scenarios based on factors such as location and market conditions.

How can mortgage data insights help in buying farmland?

Mortgage data insights can significantly aid in buying farmland by revealing land price trends, allowing prospective buyers to make informed decisions based on current market conditions and identify lucrative opportunities. Thus, leveraging these insights can enhance strategic investment in agricultural properties.