To open a bank account, you need to be prepared with the right paperwork and personal details. This guide cuts straight to the chase: a practical rundown of the essentials, so you can walk into the bank or log on to their website with confidence. Discover “what do you need open a bank account” – which IDs, documents, and information are non-negotiables for your new account—and why—without getting swamped in minutiae.

Table of Contents

Key Takeaways

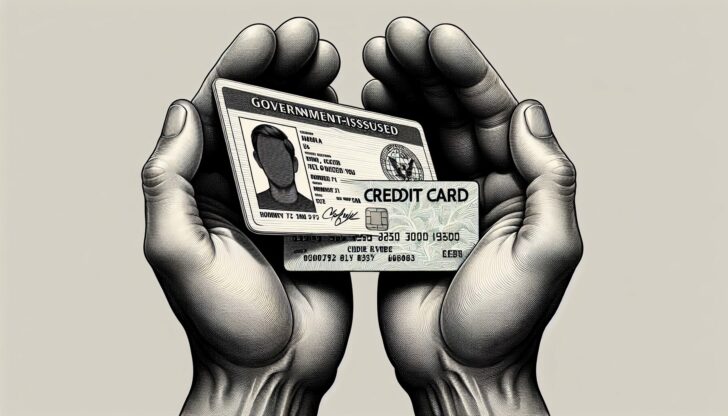

To open a bank account, primary and secondary forms of identification, such as a driver’s license and credit card, are necessary to establish identity.

Verification of the Social Security number (SSN) or Taxpayer Identification Number (TIN) is required for compliance with federal regulations and taxes, while proof of address through utility bills or a mortgage statement is required to confirm residency.

Choosing the right account type and meeting the initial deposit requirements is crucial, and additional steps include selecting between a bank and a credit union, with each offering different fees, rates, and services.

Gathering Your Identification

Embarking on the journey of opening a bank account begins with the cornerstone of identification. Imagine standing at the gates of the financial fortress; your government issued photo ID, such as a driver’s license, is the key that unlocks these gates. A driver’s license or a passport is not just a ticket to travel or a means to drive; it’s your golden ticket to the banking world.

But what if you hail from distant shores? Fret not, as non-U.S. citizens can present a potpourri of alternative identification such as a passport, alien identification card, or home country government issued photo.

Secondary Identification

But why stop at one key when two will bolster your security? A secondary form of identification serves as an added layer of assurance, proving your identity beyond a shadow of a doubt. This could be anything from a credit card to an employee or student ID, or even another document blessed by a government agency.

These personal details are the threads that weave the tapestry of your financial identity, creating a richer, fuller picture for institutions to understand who you are.

Verifying Your Social Security Number

Now, let’s talk numbers, and not just any numbers—your Social Security number (SSN) or Taxpayer Identification Number (TIN). This isn’t just a sequence of digits; it’s a numerical shadow that follows you through the labyrinth of financial bureaucracy. Banks require this to comply with federal regulations and to whisper sweet nothings about your interest income to the IRS,.

Moreover, your SSN or ITIN is a beacon that shines upon your identity, confirming you are who you say you are.

Address Confirmation Essentials

As you progress further, you’ll need to plant your flag and prove your homestead. This isn’t a mere formality; it’s a crucial declaration of your domicile. A utility bill or a mortgage statement does more than just state your consumption; it anchors you to a physical reality in the eyes of the bank,. Whether it’s the bill from your last Netflix binge or the proof of the roof over your head, these documents are your testament of residency,.

Initial Deposit Requirements

With your identity firmly established, it’s time to sow the seeds of your new financial relationship with an initial deposit. Whether you choose the crispness of cash, the certainty of a check, or the modernity of an electronic transfer, this initial offering can be a humble beginning or a grand gesture, with minimum deposit requirements varying from a minimalist $0 to a moderate $100. Bear in mind, though, that this isn’t just a deposit; it’s a commitment that could bloom into waived fees or lusher interest rates.

Account Types and Their Deposits

But what vessel to choose for your financial voyage? Here are some options:

Checking accounts: swift boats for daily transactions, with each checking account tailored for your needs

A savings account: sturdy ship for your wealth to weather the storms of time

Business bank accounts: the flagship that requires not just a captain’s personal information but also the charter of the business entity

Remember, the size of your initial treasure chest may vary bank account depending on the type of account and institution you choose.

The Process of Opening a Bank Account Online

Gone are the days of navigating through crowded banks; the digital age allows you to open a bank account online, including a checking account online, from the comfort of your abode. Here’s how an account holder can get started:

Select your desired account type like a discerning shopper.

Gather your personal documents as if assembling a dossier.

Fill out the application with the precision of a calligrapher.

However, just as you wouldn’t invite a stranger into your home, ensure you’re using a secure internet connection to keep prying eyes away from your personal information.

Required Digital Documentation

In this digital era, even documents have shed their papery skin to don a more ethereal form. You may need to whisk copies of your ID or proof of address through the virtual realms of fax or email to the awaiting arms of your chosen institution. And if you’re embracing the paperless billing world, a printed billing statement can serve as a trusty steed to carry proof of your domicile across the digital divide.

Choosing Between Bank and Credit Union

As you stand at the crossroads, you must choose your financial ally—bank or credit union? Each path offers its own landscape of fees, interest rates, and services. Credit unions, with their community-spirited ethos, often boast lower fees and better rates, but they may request a secret handshake in the form of membership criteria,.

Banks, as a type of financial institution, might offer a more diverse bouquet of services, but at the cost of higher fees, as they dance to the tune of profits and shareholders.

Learn more, visit Credit Unions vs. Banks: How to Decide.

Special Circulations for Joint Accounts

Should you choose to intertwine your financial fate with another, opening a joint account is akin to performing a duet. Both parties must take the stage together, presenting a symphony of personal information and harmonized identification. Such partnerships are not confined to the ballroom of matrimony; they are open to any duo from romantics to relatives, provided they are of the age to sign their names to this fiscal pact.

Preparing for Additional Services

As you settle into your new banking abode, consider the additional amenities you may wish to enjoy. Overdraft protection is like an insurance policy for your finances, requiring a simple opt-in but offering peace of mind.

If you’re venturing into the realm of credit services, come prepared with pay stubs or tax returns, as these are the currency of credibility in the banker’s eyes.

Managing Money: Understanding Account Features

With your account aflutter with activity, it’s paramount to understand the tools at your disposal. Your banking app is more than a digital ledger; it’s a personal finance command center, equipped to manage transfers and provide a window into your spending habits,. Embrace these digital sentinels—budgeting tools and alert systems—that stand guard over your funds, ensuring you remain within the ramparts of your financial plan,.

Transitioning from an Old Account

Transitioning from an old account to your new banking bastion should be as seamless as the passing of seasons. Here’s how to do it:

Begin by mapping out the terrain of your automatic transactions.

Gradually reroute them to your new stronghold.

Keep a watchful eye on your former account as it fades into the twilight, ensuring no obligations are left behind.

Close the chapter on this financial history.

Protecting Your New Account

Now that you’ve planted your flag in this new financial ground, it’s imperative to erect strong defenses. Here are some measures you can take:

Use unique passwords as sentinels at your gates

Enable two-factor authentication to add a moat around your treasures

Employ the secret agents of biometrics and account alerts to keep watch over your realm

Never venture into the treacherous waters of public Wi-Fi without the cloak of a VPN

Summary

As the curtain falls on this financial odyssey, you stand ready, checklist in hand, to open a bank account with the confidence of a seasoned banker. From the initial dance of documentation to the final safeguarding of your new account, you are now equipped to navigate the once-daunting labyrinth with ease. Take that first step with assurance, knowing that your financial journey is bound for success.

Frequently Asked Questions

What alternative forms of ID can non-U.S. citizens use to open a bank account?

Non-U.S. citizens can use a foreign passport, an alien identification card, or a government-issued photo ID from their home country to open a bank account. These are common alternative forms of ID accepted by many banks.

Can I open a bank account without a Social Security number?

Yes, you can open a bank account with an Individual Taxpayer Identification Number (ITIN) if you don’t have a Social Security number.

What are the minimum deposit requirements for opening a bank account?

Minimum deposit requirements for opening a bank account can vary, with some institutions requiring no deposit while others may require around $100.

How can I protect my bank account when using public Wi-Fi?

To protect your bank account when using public Wi-Fi, avoid banking transactions on public Wi-Fi and consider using a VPN to secure your connection and safeguard your financial information.

What should I do if I want to switch all my transactions from an old account to a new one?

To switch all your transactions from an old account to a new one, create a checklist of automatic transactions, update them to your new account, keep the old account active with some funds during the transition, and close it once all transactions have been successfully moved.